Securities Snapshot: 2nd Quarter 2023 - SEC Begins Summer with Blistering Rulemaking Pace

Although the U.S. Securities and Exchange Commission (“SEC”) has not yet adopted the highly-anticipated final rules on climate change disclosure, in the second quarter of 2023 the SEC continued its heated pace of rulemaking. During the quarter, the SEC’s new disclosure requirements for quarterly and annual reporting on Rule 10b5-1 trading plans and the timing of stock option awards in relation to material nonpublic information became effective. During the quarter, the SEC also adopted new issuer repurchase disclosure rules. In this Snapshot, we review the new rulemaking, the SEC’s extension of certain deadlines, and the SEC’s current rulemaking agenda.

Quarterly Reporting Requirements for Rule 10b5-1 Trading Plans

On December 14, 2022, the SEC adopted Item 408 of Regulation S-K. Item 408(a) requires quarterly disclosures regarding the adoption or termination of 10b5-1 Plans and non-Rule 10b5-1 trading arrangements in Part II, Item 5 of Form 10-Q.

Each quarter, issuers must disclose whether any director or Section 16 officer has adopted or terminated a 10b5-1 Plan or non-Rule 10b5-1 trading arrangement. Any modification or change by a director or Section 16 officer to an existing 10b5-1 Plan or non-Rule 10b5-1 trading arrangement that is treated as a termination and adoption of a new trading arrangement will also need to be disclosed.

Item 408(a) requires issuers to disclose (i) whether a trading arrangement identified in the Form 10-Q is intended to be a 10b5-1 Plan or a non-Rule 10b5-1 trading arrangement and (ii) the material terms of such plan or arrangement.

For calendar year issuers, quarterly disclosures must be provided in the Form 10-Q for the period ended June 30, 2023. Quarterly disclosures should continue to be provided in the Form 10-Q for the period ended September 30, 2023, and for such plans and arrangements adopted or terminated in the fourth quarter, the Form 10-K for the fiscal year ended December 31, 2023.

Smaller reporting companies (“SRCs”) have a delayed reporting requirement deadline and are not required to comply with the new quarterly disclosure requirements until the first full fiscal period that begins on or after October 1, 2023. For calendar year SRCs, this is the quarterly disclosure provided in the Form 10-K for the fiscal year ended December 31, 2023.

Annual Reporting Requirements for Insider Trading Policies

As part of the SEC’s adoption of Item 408, Form 10-K, Part III, Item 10 now requires issuers to disclose whether the issuer has adopted insider trading policies and procedures.

Issuers must disclose on Form 10-K or in the annual meeting proxy statement, whether it has adopted insider trading policies and procedures that are reasonably designed to promote compliance with insider trading laws, rules and regulations, as well as applicable listing standards. If the issuer has not adopted these policies and procedures, then the issuer will need to explain why it has not done so.

Issuers must also file their insider trading policies and procedures as Exhibit 19 to their Form 10-K.

Issuers are required to comply with the new disclosure requirements in the first filing that covers the first full fiscal year beginning on or after April 1, 2023. For calendar year companies, annual disclosures must first be provided in the Form 10-K for the fiscal year ended December 31, 2024. For companies with a June 30 fiscal year-end, annual disclosures must first be provided in the Form 10-K for the fiscal year ended June 30, 2024.

SRCs have a delayed reporting date and must comply with the first filing that covers the first fiscal year that begins on or after October 1, 2023. For calendar year companies, annual disclosures must first be provided in the Form 10-K for the fiscal year ended December 31, 2024. For companies with a June 30 fiscal year-end, annual disclosures must first be provided in the Form 10-K for the fiscal year ended June 30, 2025.

New Disclosure Requirements for Policies and Practices on the Timing of Option Awards

On December 14, 2022, the SEC adopted new Item 402(x) to Regulation S-K, which requires certain disclosures by issuers regarding the timing of stock option awards in relation to disclosure of material nonpublic information.

Issuers now must include in each annual meeting proxy statement and Form 10-K, information regarding the issuer’s policies and practices on the timing of grants of stock options, stock appreciation rights, and similar option-like instruments to comply with new S-K Item 402(x). The rule does not apply to restricted stock, restricted stock units, or performance units.

Issuers must provide a narrative disclosure regarding their policies and practices on the timing of stock option awards in relation to the disclosure of material nonpublic information.

Additionally, issuers will be required to disclose in a new table any options granted to named executive officers within four business days before, or one business day after the (i) filing of a periodic report on Form 10-Q or 10-K or (ii) filing or furnishing, as the case may be, a current report on Form 8-K announcing material nonpublic information.

Issuers are required to disclose stock option awards both quarterly and annually. Issuers must provide their first quarterly disclosure in the first filing that covers the first full fiscal period that begins on or after April 1, 2023. For calendar year companies, this is the issuer’s Form 10-Q for the period ended June 30, 2023. Annual disclosures are required to begin in the first filing that covers the first full fiscal year beginning on or after April 1, 2023. For calendar year companies, this is the issuer’s Form 10-K for the fiscal year ended December 31, 2024.

Issuer Repurchase Disclosure Rules

On May 3, 2023, the SEC adopted amendments to Item 403 of Regulation S-K relating to issuers’ repurchases of their equity securities. The amendment requires issuers to include both quantitative and narrative disclosures regarding share repurchases.

The amendments require quantitative disclosures in a tabular format. The table must show the issuer’s repurchase activity each quarter, aggregated on a daily basis. The amendments also expand the narrative disclosure of repurchases in Regulation S-K to require an issuer to disclose: (1) the objectives or rationales for its share repurchases and the process and criteria used to determine the amount of repurchases; and (2) any policies and procedures relating to purchases and sales of issuer’s securities during a repurchase program by its officers and directors.

For a more comprehensive review of the new issuer repurchase disclosure rules, see our blog post linked here. Additionally, for information regarding the lawsuit against the SEC challenging the new repurchase rules, see our blog post linked here.

Officer Exculpation in Delaware – Where Are We Now?

On August 1, 2022, Delaware General Corporation Law Section 102(b)(7) was amended to extend exculpation rights to executive officers. This new amendment permits a corporation to adopt exculpatory language in its certificate of incorporation to limit the personal liability of officers in addition to directors.

Both Institutional Shareholder Services Inc. (“ISS”) and Glass Lewis approach officer exculpation proposals on a case-by-case basis. However, ISS stated it is generally in favor of officer exculpation proposals and Glass Lewis stated it is generally opposed to officer exculpation provisions. Institutional investors, such as BlackRock, State Street, and Vanguard are yet to release policies on officer exculpation. Their 2023 voting policies remain silent on the issue.

Between August 1, 2022 and June 1, 2023, over 200 public companies in the Russell 3000, including 26 S&P 500 companies, included proposals in their proxy statements to amend their charters to provide for officer exculpation. As of June 1, 2023, slightly over half of these proposals to approve officer exculpation charter amendments have been submitted to a stockholder vote at Russell 3000 companies. Of these proposals, over 90% passed with an average of over 70% stockholder support.[1]

In response to the amendment to the Delaware General Corporation Law, boards of Delaware corporations should consider amending their certificate of incorporation to include officer exculpation provisions. Given the high level of support from both stockholders and proxy advisory services, we expect the number of proposals to continue to increase.

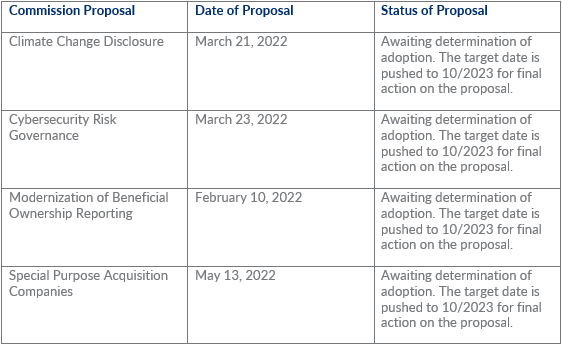

Status of Select Commission Rulemaking

The SEC has delayed its anticipated timing for several closely followed rules, including its climate change disclosure rule. The SEC’s latest Reg Flex Agenda was recently released, extending the timing for the climate disclosure rules, among several other rulemakings, to October 2023.

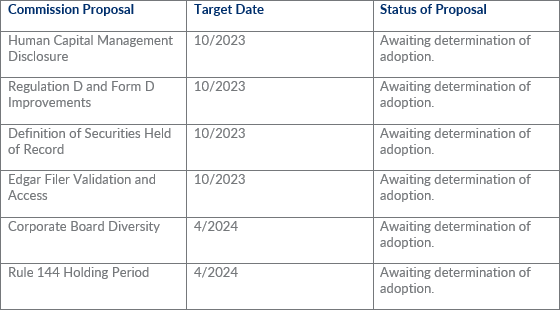

Additionally, the following anticipated key rules are slated for initial proposal on the Reg Flex Agenda:

Should you have any questions or need assistance, please contact us.

James C. Kennedy

513.579.6599

jkennedy@kmklaw.com

F. Mark Reuter

513.579.6469

freuter@kmklaw.com

Allison A. Westfall

513.579.6987

awestfall@kmklaw.com

Olivia M. King

513.579.6988

oking@kmklaw.com

[1] White & Case: Amending Bylaws and Charters to Address Universal Proxy, Shareholder Activism and Officer Exculpation (June 1, 2003).

KMK Law articles and blog posts are intended to bring attention to developments in the law and are not intended as legal advice for any particular client or any particular situation. The laws/regulations and interpretations thereof are evolving and subject to change. Although we will attempt to update articles/blog posts for material changes, the article/post may not reflect changes in laws/regulations or guidance issued after the date the article/post was published. Please consult with counsel of your choice regarding any specific questions you may have.

ADVERTISING MATERIAL.

© 2026 Keating Muething & Klekamp PLL. All Rights Reserved