SEC Adopts Amendments Requiring Disclosure of Issuer Share Repurchases

On May 3, 2023, the Securities and Exchange Commission adopted amendments to Item 703 of Regulation S-K which were proposed in December 2021 as part of the SEC’s goal of “improving the quality, relevance and timeliness” of issuer share repurchase disclosures. The amendments require additional disclosure from issuers, including disclosure of the issuer’s reasons for its share repurchase and disclosure aggregated on a daily basis. As adopted, disclosure of share repurchases will not be required within one business day.

Issuers will be required to comply with the amendments on Forms 10-Q and 10-K (for their fourth fiscal quarter) beginning with the first filing that covers the first full fiscal quarter that begins on or after October 1, 2023.

Daily Share Repurchase Disclosure

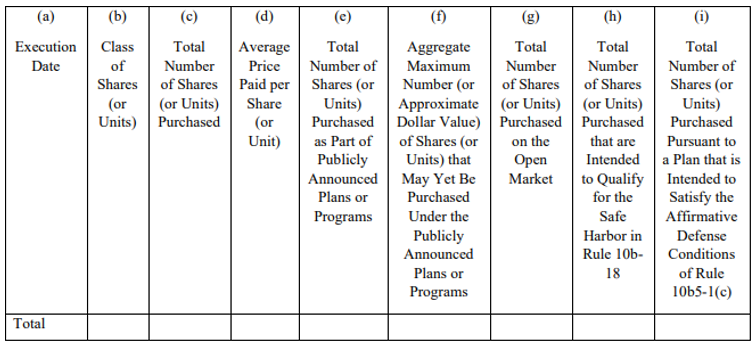

The amendments require tabular disclosure of an issuer’s repurchase activity aggregated on a daily basis either quarterly or semi-annually, depending on the type of issuer. The table will include, for each day:

- The class of shares;

- Average price paid per share;

- Total number of shares purchased, including the total number of shares purchased as part of a publicly announced plan;

- Aggregate maximum number of shares (or approximate dollar value) that may yet be purchased under a publicly announced plan;

- Total number of shares purchased on the open market; and

- Total number of shares purchased that are intended to qualify for the safe harbor in Rule 10b-18 and separately the total number of shares purchased pursuant to a plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c).

The amendments eliminate the current requirements in Regulation S-K to disclose monthly repurchase data in periodic reports and instead require tabular disclosure of daily repurchases in Exhibit 26 to the Form 10-Q or 10-K. An example of the new Exhibit 26 is attached below as Annex A.

Issuers must include a checkbox preceding the tabular disclosure identifying whether its Section 16 officers and directors purchased or sold shares that are the subject of an issuer share repurchase plan within four business days before or after the announcement of that plan or program.

Quarterly Narrative Disclosure

The amendments also expand the requirements for narrative disclosure of repurchases in Regulation S-K to require an issuer to disclose: (1) the objectives or rationales for its share repurchases and the process or criteria used to determine the amount of repurchases; and (2) any policies and procedures relating to purchases and sales of the issuer’s securities during a repurchase program by its officers and directors, including any restriction on such transactions.

The amendments also added new Item 408(d) of Regulation S-K to require quarterly disclosure in reports on Forms 10-Q and 10-K about an issuer’s adoption and termination of Rule 10b5-1 trading arrangements and the material terms of such arrangements, including date of plan adoption or termination, plan duration, and amount of securities subject to the plan.

Annex A

Should you have any questions or need assistance, please contact us.

James C. Kennedy

513.579.6599

jkennedy@kmklaw.com

F. Mark Reuter

513.579.6469

freuter@kmklaw.com

Allison A. Westfall

513.579.6987

awestfall@kmklaw.com

Olivia M. King

513.579.6988

oking@kmklaw.com

KMK Law articles and blog posts are intended to bring attention to developments in the law and are not intended as legal advice for any particular client or any particular situation. The laws/regulations and interpretations thereof are evolving and subject to change. Although we will attempt to update articles/blog posts for material changes, the article/post may not reflect changes in laws/regulations or guidance issued after the date the article/post was published. Please consult with counsel of your choice regarding any specific questions you may have.

ADVERTISING MATERIAL.

© 2026 Keating Muething & Klekamp PLL. All Rights Reserved