Benefits Monthly Minute

IRS Updates Health and Retirement Plan Benefit and Contribution Limits for 2021

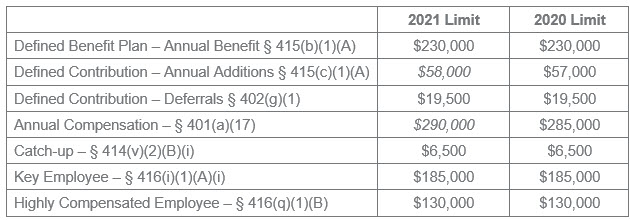

On October 26, 2020, the IRS released Notice 2020-79 announcing adjusted retirement plan limits for 2021. Noted below are selected 2021 limits as reported in the Notice, most of which remained unchanged but there are a few increases:

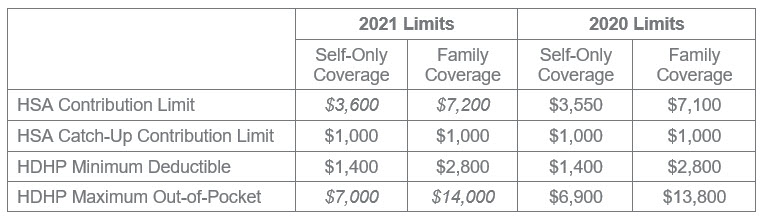

The IRS also announced 2021 Health Savings Account (“HSA”) contribution limits and 2021 minimum deductible and maximum out-of-pocket amounts for high deductible health plans (“HDHPs”) in Revenue Procedure 2020-32. There was no change to the HSA catch-up contribution limit or the HDHP minimum deductible amount. The 2021 HSA contribution limits and HDHP amounts set forth in the Revenue Procedure are as follows:

KMK Comment: plan sponsors should review plan documents and participant communications to ensure the applicable plan limits for 2021 are accurately reflected.

ESRP Penalties Increase for 2021

In newly released guidance on the Employer Shared Responsibility Provisions of the Affordable Care Act, the IRS communicated the 2021 adjustments to ESRP penalties in Q&A #55. The adjusted ESRP amounts are:

- (a) penalty (Failure to Offer Minimum Essential Coverage to at Least 95% of Full-Time Employees): $2,700/year x the number of full-time employees (minus 30)

- (b) penalty (Offer of Coverage was Unaffordable or Did Not Provide Minimum Value): $4,060/year x the number of full-time employees receiving premium tax credits

KMK Comment: although the penalty increase comes as no surprise, it serves as an important reminder to confirm plan operations for applicable large employers are fully compliant with ACA coverage requirements.

More Relief for Furnishing 2020 ACA Information Returns

IRS Notice 2020-76 has extended the due date for certain 2020 ACA information-reporting requirements from January 31, 2021, to March 2, 2021. Also extended under this Notice is relief from section 6721 and section 6722 penalties for certain aspects of these 2020 ACA information-reporting requirements.

To recap, section 6055 requires health insurance issuers, self-insuring employers, and other providers of minimum essential coverage (MEC) to file and furnish annual information returns and statements. Section 6056 requires applicable large employers (generally, those with 50 or more full-time employees) to file and furnish annual information returns and statements relating to coverage offered to full-time employees. Section 6721 and 6722 penalties are imposed with regard to late/incorrect/incomplete information returns and statements required by sections 6055 and 6056, and the IRS has designated Form 1094-B and Form 1095-B to meet the requirements of section 6055, and Form 1094-C and 1095-C to meet the section 6056 requirements (although self-insured large employers file a single set of C-forms).

According to IRS Notice 2020-76, because employers, insurers, and other providers need additional time beyond the January 31, 2021 due date to gather and analyze information and prepare the 2020 Forms 1095-B and 1095-C to be furnished to individuals, the due date for furnishing the 2020 Forms 1095-B and 1095-C, is extended from January 31, 2021, to March 2, 2021. Unfortunately, this Notice does not extend the due date for filing with the IRS. In addition, for 2020, the IRS will not assess a penalty under section 6722 for failing to furnish a Form 1095-B to responsible individuals where two conditions are met:

- the reporting entity posts a notice prominently on its website stating that responsible individuals may receive a copy of their 2020 Form 1095-B upon request, along with an email, mailing address and telephone number; and

- the reporting entity must furnish a 2020 Form 1095-B to any responsible individual upon request within 30 days.

(Note: this relief does not extend to the furnishing of Forms 1095-C to full-time employees.)

This Notice also provides a final extension of relief from sections 6721 and 6722 penalties to reporting entities that report incorrect or incomplete information where good faith compliance efforts are shown; however, reporting entities which fail to file returns or furnish statements by the extended due dates are generally not eligible for relief. This is the last year the Treasury Department and the IRS intend to provide this relief.

KMK Comment: the relief provided under Notice 2020-76 is welcomed news; however, providers should take care not to rely on a further extension of relief in future years. And, more importantly, keep in mind that the IRS filing deadlines (generally, on or before February 28 if filing on paper, or March 31 if filing electronically) remain unchanged.

The KMK Law Employee Benefits & Executive Compensation Group is available to assist with these and other issues.

Lisa Wintersheimer Michel

Partner

513.579.6462

lmichel@kmklaw.com

John F. Meisenhelder

Partner

513.579.6914

jmeisenhelder@kmklaw.com

Helana A. Darrow

Partner

513.579.6452

hdarrow@kmklaw.com

Antoinette L. Schindel

Partner

513.579.6473

aschindel@kmklaw.com

Kelly E. MacDonald

Associate

513.579.6409

kmacdonald@kmklaw.com

KMK Employee Benefits and Executive Compensation email updates are intended to bring attention to benefits and executive compensation issues and developments in the law and are not intended as legal advice for any particular client or any particular situation. Please consult with counsel of your choice regarding any specific questions you may have.