Benefits Monthly Minute

Good News for Retirement Savers

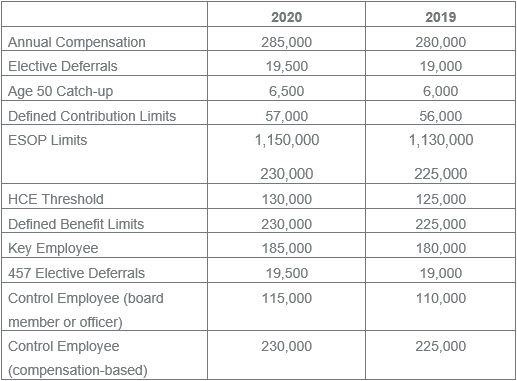

This month the IRS announced increased retirement plan contribution limits for 2020. Employees in 401(k) plans will be able to contribute up to $19,500 next year, and the catch-up contribution limit for employees aged 50 and over has increased from $6,000 to $6,500. The complete list of notable employer retirement plan increases are summarized below:

The increased contribution limits for employer sponsored retirement plans stand in contrast to the more stagnant limits for IRAs: the limit on annual contributions to an IRA is unchanged at $6,000, along with the IRA catch-up contribution limit which remains at $1,000 for individuals aged 50 or older.

Changes to the SBC Template for 2021

Plans and issuers will be required to use the new 2021 Summary of Benefits and Coverage (SBC) template in connection with coverage and plan years beginning on or after January 1, 2021. Updated instructions and other materials are also available on the agencies' websites. Specifically,

- The new form revises the minimum essential coverage statement to reference the impact on premium tax credit eligibility, and removes the reference to the individual mandate (given the mandate has been effectively eliminated),

- Likewise, the Uniform Glossary has removed references to the individual mandate,

- The new template also summarizes certain different types of minimum essential coverage (although it does not explicitly refer to employer sponsored plans),

- Related material updates include a "crosswalk" document that details changes made to the October 2019 version of the Coverage Examples Calculator.

Although the changes are not drastic, plan sponsors will want to familiarize themselves with the new template and ensure that it is used in connection with open enrollment for the 2021 plan year.

Securities Law v. ERISA Duties

Lawsuits by 401(k) plan participants related to employer stock in a 401(k) plan are nothing new. These lawsuits typically allege that ERISA plan fiduciaries failed to protect employees' retirement savings when the employer stock price falls. In the wake of the U.S. Supreme Court's Dudenhoeffer decision, which included the elimination of the presumption of prudence, these suits are often dismissed. However, during oral arguments for the case of IBM et al. v. Jander et al., the Supreme Court is now faced with reconciling the tension between federal securities law and ERISA fiduciary duty standards. The IBM case asks whether IBM insiders, who were also plan fiduciaries, were required to promptly disclose IBM's struggles that led to a drop in IBM's stock price. IBM argued that the justices should "address fiduciaries' obligations under securities law when deciding what standards courts should use to evaluate ERISA stock cases." IBM workers, on the other hand, contended that IBM should have made an earlier disclosure of its failing microelectronics business based on ERISA fiduciary duty standards. Some commentators expect conservative justices to side with IBM given the tension that arises when requiring ERISA plan fiduciaries to disclose inside information, while others suggest, in line with Justice Breyer's comments, that the question the Court agreed to decide was under ERISA, not securities law. At this stage, it is unclear what direction the case will go -- we will keep you updated on the Court's decision.

KMK Employee Benefits and Executive Compensation email updates are intended to bring attention to benefits and executive compensation issues and developments in the law and are not intended as legal advice for any particular client or any particular situation. Please consult with counsel of your choice regarding any specific questions you may have.