Securities Snapshot: 1st Quarter 2024

While your winter blues are hopefully melting away, recent rule making from the Securities and Exchange Commission is feeling the heat of several lawsuits. In this Snapshot, we review the legal challenges facing the SEC’s highly anticipated climate-disclosure rules. We also address how the SEC’s proxy advisor rules were held invalid and the SEC’s announcement that its share repurchase modernization rules will revert to those in effect prior to the new rule’s effective date. The legal challenges do not stop at the SEC, however, as Nasdaq is also defending a lawsuit related to its director diversity matrix rules.

SEC’s Long-Awaited Climate Disclosure Rules

Summary of Rules

On March 6, 2024, the SEC adopted its highly anticipated climate-related disclosure rules. The final rules are meaningfully scaled back from the proposed rules, notably eliminating the proposed requirement to disclose Scope 3 greenhouse gas (“GHG”) emissions. The final rules provided a phased compliance runway that is based on a registrant’s filer status and the content of the disclosure.

The final rules add a new subpart 1500, Climate-Related Disclosure, to Regulation S-K. This requires extensive disclosure regarding climate-related risks, transition plans, targets and goals, risk management, governance and greenhouse gas (“GHG”) emissions. The final rules also require a registrant to disclose in a note to the financial statements certain specified climate-related financial statement effects of severe weather events and other natural conditions and related information. This new subpart is applicable to Exchange Act periodic reports and Securities Act and Exchange Act registration statements.

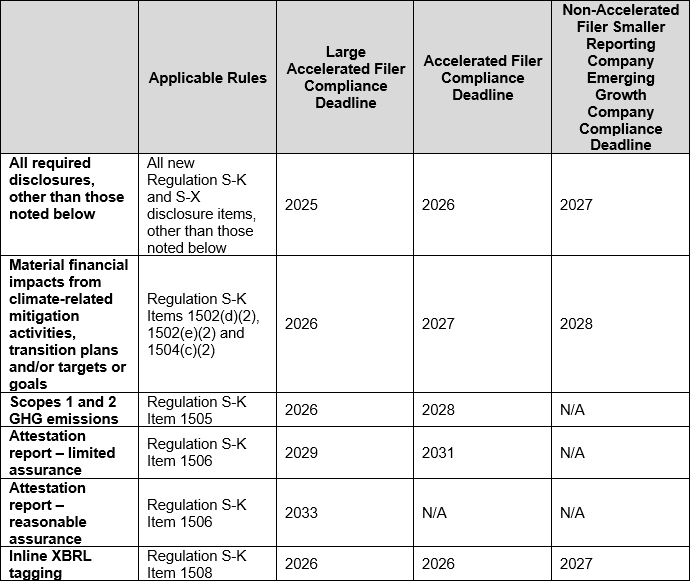

The final rules will become effective 60 days after publication in the Federal Register. References to "the fiscal year beginning" mean that the disclosure will need to capture that applicable year. Therefore, for US, calendar year end issuers who are also large accelerated filers, the first disclosure requirements will be in effect for Forms 10-K for the fiscal year ended December 31, 2025, to be filed in early 2026. Compliance will be phased in as follows:

Legal Challenges

However, the new rules are already facing legal challenges. On March 15, 2024, the U.S. Court of Appeals for the Fifth Circuit issued a stay of the Securities and Exchange Commission’s new climate-disclosure rules. The three-judge panel granted the requests for injunctive relief brought by seven companies, trade associations and three states, which asserted that being required to comply with the rules would result in irreparable harm. The panel did not elaborate on the rationale behind its decision. However, the SEC moved to consolidate the various lawsuits challenging the climate-disclosure rules. The consolidated litigation landed in the Eighth Circuit. As a result, on March 25, 2024, the Fifth Circuit lifted their stay. Whether the Eighth Circuit reinstitutes the stay remains to be seen. KMK will continue to track the pending litigation and any SEC guidance provides as a result.

For a summary of the climate-disclosure rules and the legal challenges the rule faces, see our Securities Advisory: SEC Adopts New Rules for Climate-Related Disclosures; Lawsuits Challenge New Rules and our Blog Post: New SEC Climate Disclosure Rules – Temporarily Stayed.

Special Purpose Acquisition Companies

On January 24, 2024, the SEC adopted final rules relating to special purpose acquisition companies (“SPACs”) and de-SPAC transactions. The SPAC rules are intended to enhance disclosures and provide additional investor protection in SPAC initial public offerings (“IPOs”) and subsequent de-SPAC transactions with target companies. The rules also broadly address investor protection concerns with respect to shell companies and blank check companies, including SPACs.

The final rules implement a new subpart 1600 to Regulation S-K, which sets forth disclosure requirements for SPAC IPOs and de-SPAC transactions. The new rules include enhanced and more prominent disclosure requirements regarding, among other things, SPAC sponsors (including its experience, rights, interests, and compensation), the target entity, and potential or actual material conflicts of interest. The rules also require disclosure of the potential dilution of purchaser’s equity interests and agreements in place with the SPAC. The board of directors (or similar governing body) also must disclose their determination on whether the de-SPAC transaction is advisable and in the best interests of the SPAC and its shareholders, including whether it has received an outside report, opinion or appraisal materially relating to the approval or fairness of the transactions. There are also certain disclosures on the prospectus cover page and prospectus summary, including features relating to the SPAC offering or de-SPAC transaction and the potential associated risks.

The new SPAC rules also enhance investor protections in shell company business combinations. The SEC adopted Rule 145a, which provides that any direct or indirect business combination of a reporting shell company involving another entity that is not a shell company, will be deemed to be a sale of securities of the operating company to the shell company shareholders. This is regardless of whether or not any shares actually exchange hands. As a result, the transactions will be subject to all relevant disclosure and other requirements for a sale of securities under the Securities Act.

The new SPAC rules also require new disclosures for projections used in connection with de-SPAC transactions. These disclosures include:

- The purpose for which the projections were prepared and who prepared such projections;

- All material bases and assumptions underlying the projections, and any material factors that may affect such assumptions; and

- Whether the projections still reflect the view of the board or management of the SPAC or target company, as applicable, as of the most recent practicable date prior to the date of the document being disseminated to shareholders.

Nasdaq Diversity Grid Litigation

The Nasdaq rule requiring companies to disclose board diversity or lack thereof has been challenged in the U. S. Court of Appeals for the Fifth Circuit. On February 20, 2024, the court agreed to rehear a challenge by two groups after an earlier panel of the Court upheld the diversity requirement. The hearing is tentatively scheduled for arguments in mid-May.

The Nasdaq rule requires companies to disclose the details about the diversity of their boards and to have a minimum number of women and minorities on their boards, or explain why they do not. The SEC approved the proposed rules in August 2021, finding that the rule could encourage some Nasdaq-listed companies to increase diversity on their boards while noting that the rules did not mandate any particular board composition.

Proxy Advisor Rules Held Invalid

After 1,576 days, the DC District Court held that the SEC’s rule regarding proxy advisory firms is invalid. The case dates back to 2019 following the SEC’s interpretive guidance that proxy advisory firms’ vote recommendations were, in the view of the SEC, “solicitations” under the proxy rules and subject to the anti-fraud provisions of Rule 14a-9. Rules confirming that interpretation were adopted in 2020. Then, on July 13, 2022, the SEC amended its proxy solicitation rules to rescind portions of the rules. Importantly, however, under the 2022 amendments, proxy voting advice would still be considered a “solicitation” under proxy rules and proxy advisors would still be subject to the requirement to disclose conflicts of interest. When the SEC took action, it did not change the definition of the term “solicitation” from the 2019 interpretation and guidance and the 2020 amendments. This gave rise to additional legal challenges, which resulted in the District Court holding that the “SEC acted contrary to law and in excess of statutory authority.” For previous discussion of the 2020 rules and 2022 amendments, see our publications linked here and here.

Share Repurchase Disclosure Modernization Rule

On February 9, 2024, the SEC announced that the disclosure requirements regarding an issuer’s share repurchases revert to the previous requirements. Companies do not have to comply with the requirements in the new rule as was originally anticipated. This announcement follows a decision from the U.S. Court of Appeals for the Fifth Circuit on December 19, 2023, which vacated the share repurchase disclosure modernization rule. Companies must still comply with the old share repurchase rule, under which companies are required to disclose the monthly aggregate of their share repurchases in a tabular format.

For additional information regarding the share repurchase disclosure modernization rule, see our blog post linked here. For information regarding the subsequent legal developments, please see our previous publications linked here and here.

Proxy Season Reminder: ARS Submissions

In the beginning of the 2023 proxy season, new SEC rules went into effect requiring companies to furnish a PDF of the company’s Rule 14a-3 annual shareholders report under the header submission type “ARS.” This rule replaces the requirement to send a hard copy of the annual report to the SEC, which the SEC deemed satisfied by posting the annual report to the company’s website.

Effective January 2023, the amended rule applies to both standalone “glossy” annual reports and annual reports that use the “10-K wrap” approach, under which “glossy” pages are wrapped around the Form 10-K. The annual report should be filed on EDGAR as an “ARS” filing, which is due no later than the date on which the annual report is first sent or given to shareholders. While publishing the annual report on a company’s corporate website is now optional, companies are still required to post a copy of the annual report to a website other than EDGAR pursuant to Rule 14a-16(b) of the Exchange Act.

For the 2024 proxy season, companies should consider the ARS submission into their proxy filing and annual meeting timeline. The PDF that is submitted as the ARS is typically filed right after the company’s DEF 14A has been filed. The ARS submission is not required to be tagged using XBRL. Additionally, the new EDGAR submission requirement does not affect the delivery of the Rule 14a-3 annual report. Rule 14a-3(b) requires that the proxy statement be “accompanied or preceded by an annual report,” and, under Rule 14a-16, the proxy statement and annual report have to be posted online at the same time.

Should you have any questions or need assistance, please contact us.

James C. Kennedy

513.579.6599

jkennedy@kmklaw.com

F. Mark Reuter

513.579.6469

freuter@kmklaw.com

Allison A. Westfall

513.579.6987

awestfall@kmklaw.com

Olivia M. King

513.579.6988

oking@kmklaw.com

KMK Law articles and blog posts are intended to bring attention to developments in the law and are not intended as legal advice for any particular client or any particular situation. The laws/regulations and interpretations thereof are evolving and subject to change. Although we will attempt to update articles/blog posts for material changes, the article/post may not reflect changes in laws/regulations or guidance issued after the date the article/post was published. Please consult with counsel of your choice regarding any specific questions you may have.

ADVERTISING MATERIAL.

© 2024 Keating Muething & Klekamp PLL. All Rights Reserved