Changes to Schedule 13D and 13G: SEC Adopts Amendments Modernizing Beneficial Ownership Reporting

On October 10, 2023, the U.S. Securities and Exchange Commission (“SEC”) adopted certain of its proposed changes to modernize the rules governing beneficial ownership reporting. However, not all proposed rules were adopted; the SEC issued guidance in lieu of adopting certain proposed rules. The adoption updates rules that first went into effect more than 50 years ago, which SEC Chair Gary Gensler believed were “antiquated.”

The adopted rule amendments: (i) shorten the deadlines for initial and amended Schedule 13D and 13G filings; (ii) require that Schedule 13D and 13G filings be made using a structured, machine-readable data language; and (iii) clarify the Schedule 13D disclosure requirements with respect to derivative securities.

Schedules 13D and 13G Filing Deadlines:

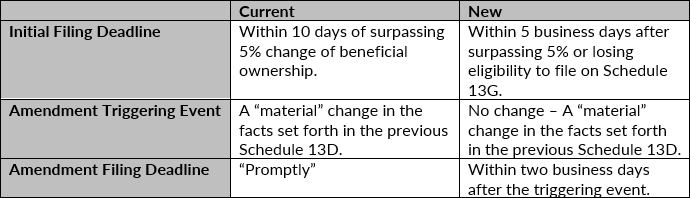

The SEC’s amendments shorten the deadlines for initial and amended filings for both Schedule 13D and Schedule 13G filers. For Schedule 13D, the amendments shorten the initial filing deadline from 10 days to five business days. Additionally, any amendments to Schedule 13D must now be filed within two business days. Our attached Annex A summarizes the various filing and amendment deadlines.

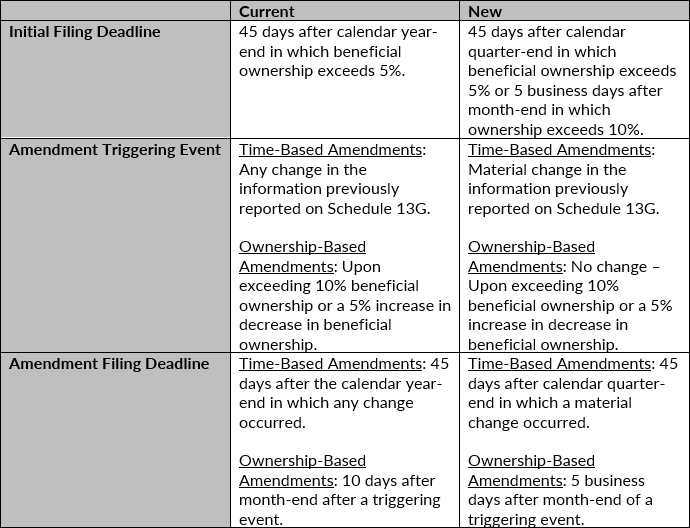

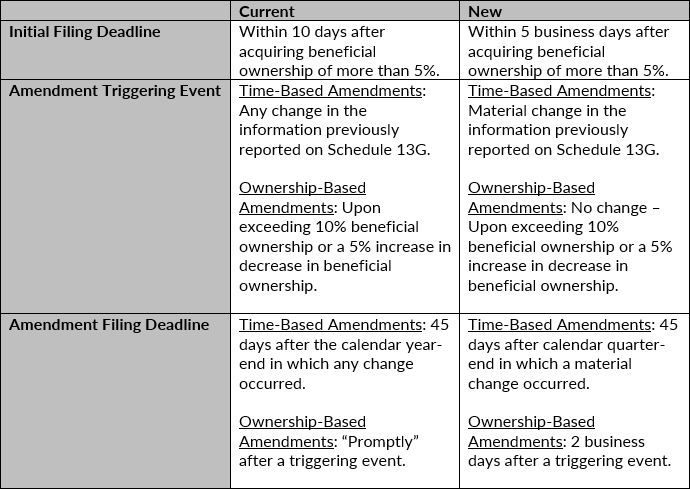

The amendments also shorten the initial filing deadline for qualified institutional investors and exempt investors from 45 days after the end of a calendar year to 45 days after the end of the calendar quarter in which the investor beneficially owns more than five percent of the covered class of securities. For passive investors, the amendments shorten the initial filing deadline from 10 days to five business days. In addition, all Schedule 13G filers are now required to file an amendment 45 days after the calendar quarter in which a material change has occurred, rather than 45 days after the calendar year in which any change occurred.

The amendments also accelerate the Schedule 13G obligations for qualified institutional investors and passive investors when their beneficial ownership exceeds 10 percent or increases or decreases by five percent of the covered class of securities. Passive investors must file an initial Schedule 13G, or amendment to Schedule 13G, as the case may be, within two business days of their beneficial ownership exceeding ten percent and file an amendment within two business days of a five percent increase or decrease in beneficial ownership; the filing deadline for qualified institutional investors is five business days after the end of a month in which beneficial ownership exceeds 10% or a 5% increase or decrease in beneficial ownership.

Required Data Language:

Additionally, Schedules 13D and 13G must be filed using a structured, machine-readable data language, including all exhibits thereto. This requirement is intended to make it easier for market participants to access, compile and analyze information disclosed on Schedules 13D and 13G. To ease the administrative burdens associated with the shortened deadlines, the amendments extend the filing cut-off times in Regulation S-T for Schedules 13D and 13G from 5:30 p.m. to 10:00 p.m. Eastern Standard Time.

Derivative Securities:

To remove uncertainty as to the scope of Schedule 13D disclosure requirements with respect to derivative securities, the final rules amend Item 6 of Schedule 13D to clarify that a person is required to disclose interests in all derivative securities that use an issuer’s equity security as a reference security. This includes cash-settled options. The adopting release also provides guidance on the applicability of current Rule 13d-3 to cash-settled derivative securities, other than security-based swaps.

Group Formation Guidance:

The SEC also provided guidance on the applicability of existing beneficial ownership rules regarding group formations, which the SEC provided rather than adopting the rules as originally proposed. The guidance sets forth that, depending on particular facts and circumstances, concerted actions by two or more persons for the purpose of acquiring, holding, or disposing of securities of an issuer are sufficient to constitute the formation of a group regardless of the existence of an express agreement to that effect.

Timing:

The revised Schedule 13D filing requirements are effective 90 days after publication to the Federal Register. The revised Schedule 13G filing deadlines begin on September 20, 2024. Finally, the structured data requirements begin on December 18, 2024.

Annex A

Schedule 13D:

Schedule 13G for Qualified Institutional Investors:

Schedule 13G for Passive Investors:

Should you have any questions or need assistance, please contact us.

James C. Kennedy

513.579.6599

jkennedy@kmklaw.com

F. Mark Reuter

513.579.6469

freuter@kmklaw.com

Allison A. Westfall

513.579.6987

awestfall@kmklaw.com

Olivia M. King

513.579.6988

oking@kmklaw.com

KMK Law articles and blog posts are intended to bring attention to developments in the law and are not intended as legal advice for any particular client or any particular situation. The laws/regulations and interpretations thereof are evolving and subject to change. Although we will attempt to update articles/blog posts for material changes, the article/post may not reflect changes in laws/regulations or guidance issued after the date the article/post was published. Please consult with counsel of your choice regarding any specific questions you may have.

ADVERTISING MATERIAL.

© 2024 Keating Muething & Klekamp PLL. All Rights Reserved