SEC Adopts New Rules for Climate-Related Disclosures; Lawsuits Challenge New Rules

On March 6, 2024, the Securities and Exchange Commission adopted its highly anticipated climate-related disclosure rules. The rules faced public scrutiny since their proposal two years ago, with the SEC receiving more than 24,000 comment letters. The final rules are meaningfully scaled back from the proposed rules, notably eliminating the proposed requirement to disclose Scope 3 greenhouse gas emissions. The final rules provide a phased compliance runway based on a registrant’s filer status and the content of the disclosure. Immediately upon adoption, the final rules were met with lawsuits that challenge their validity and enforceability. While states and businesses claim the new rules go too far, environmental groups say the rules fail to fully shield investors from the risks of climate change.

Climate-Related Disclosures and Other Requirements

The final rules add a new subpart 1500, Climate-Related Disclosure, to Regulation S-K, which requires extensive disclosure regarding climate-related risks, transition plans, targets and goals, risk management, governance and greenhouse gas (“GHG”) emissions. This new subpart is applicable to Exchange Act periodic reports and Securities Act and Exchange Act registration statements.

Board and Management Oversight

Under new Item 1501(a), companies must disclose any oversight by the company’s board of directors of climate-related risks. This disclosure requirement includes the role of any committees or subcommittees and how such committees or subcommittees are informed of the risks. The company must disclose any processes the registrant has for identifying, assessing, and managing material climate-related risks and, if the registrant is managing those risks, whether and how any such processes are integrated into the registrant's overall risk management system or processes.

Climate-Related Risks, Targets and Goals, and Risk Management

New Items 1502, 1503, and 1504 of Regulation S-K add disclosure requirements for certain climate-related information. The disclosure requirements include:

- Climate-related risks that have materially impacted or are reasonably likely to have a material impact on the registrant, including on its business strategy, results of operations, or financial condition.

- The actual or potential material impacts of any identified climate-related risks on the registrant’s business strategy, results of operations, or financial condition.

- Information about a registrant's climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect the registrant's business, results of operations, or financial condition. Disclosures would include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal.

- If, as part of its strategy, a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities.

- Specified disclosures regarding a registrant's activities, if any, to mitigate or adapt to a material climate-related risk including the use, if any, of transition plans, scenario analysis, or internal carbon prices.

Scope 1 and Scope 2 Emissions Disclosure

For large accelerated filers and accelerated filers not also smaller reporting companies or emerging growth companies, the new rules require disclosure of Scope 1 and Scope 2 GHG emissions. Smaller reporting companies and emerging growth companies are exempt from emission disclosure requirements.

When Scope 1 and/or Scope 2 emissions disclosure is required, the disclosure must include a description of the company’s methodology, significant inputs, significant assumptions, organizational boundaries, operational boundaries and the reporting standard used to calculate the emissions. Emissions disclosure will be required to be provided for the most recently completed fiscal year and, to the extent previously disclosed, for the historical year(s) included in the filing.

Companies providing such Scope 1 and Scope 2 emissions disclosure must also provide an attestation report initially at the limited assurance level. Following an additional transition period, large accelerated filers will be required to provide attestation reports at the reasonable assurance level.

Financial Statement Disclosure

New Regulation S-X Article 14 will require a registrant to disclose in a note to the financial statements for the most recently completed fiscal year (and to the extent previously disclosed or required to be disclosed, for the historical fiscal year(s), for which audited consolidated financial statements are included in the filing), certain specified climate-related financial statement effects of severe weather events and other natural conditions and related information. The disclosure requirements include:

- The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements.

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant's plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements.

- If the estimates and assumptions a registrant uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted, disclosed in a note to the financial statements.

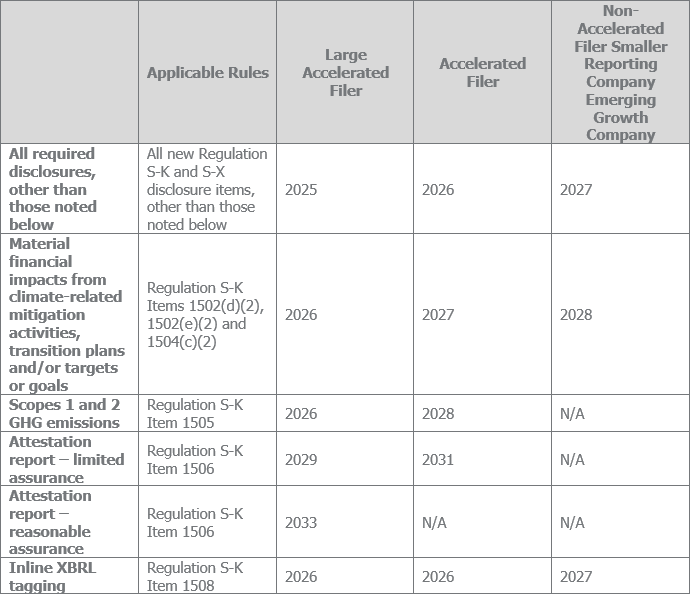

Compliance Dates

The final rules will become effective 60 days after publication in the Federal Register. References to "the fiscal year beginning" mean that the disclosure will need to capture that applicable year. For U.S. calendar year large accelerated filers, the first disclosure requirements will be in effect for Forms 10-K for the fiscal year ended December 31, 2025, to be filed in early 2026. Compliance will be phased in as follows:

Legal Challenges to Final Rule

The new rules are already facing a gauntlet of legal challenges. Within hours of adoption, ten states filed a petition for review in the Eleventh Circuit. The petition states that “the final rule exceeds the agency’s statutory authority and otherwise is arbitrary, capricious, an abuse of discretion, and not in accordance with the law” and asks the Eleventh Circuit to declare the rule “unlawful and vacate the Commission’s final action.” In its lawsuit against the SEC, the Sierra Club claims the rules for not going far enough. KMK will continue to monitor the litigation and any guidance issued by the SEC with respect to the rule’s implementation.

Should you have any questions or need assistance, please contact us.

James C. Kennedy

513.579.6599

jkennedy@kmklaw.com

F. Mark Reuter

513.579.6469

freuter@kmklaw.com

Allison A. Westfall

513.579.6987

awestfall@kmklaw.com

Olivia M. King

513.579.6988

oking@kmklaw.com

KMK Law articles and blog posts are intended to bring attention to developments in the law and are not intended as legal advice for any particular client or any particular situation. The laws/regulations and interpretations thereof are evolving and subject to change. Although we will attempt to update articles/blog posts for material changes, the article/post may not reflect changes in laws/regulations or guidance issued after the date the article/post was published. Please consult with counsel of your choice regarding any specific questions you may have.

ADVERTISING MATERIAL.

© 2024 Keating Muething & Klekamp PLL. All Rights Reserved