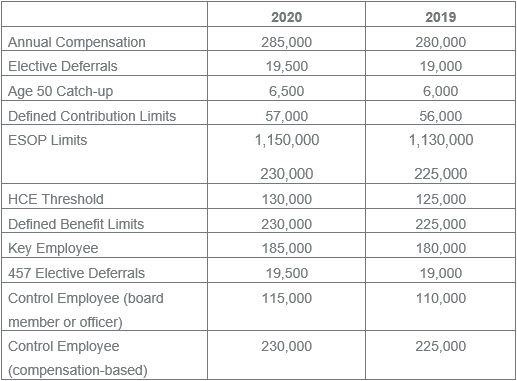

This month the IRS announced increased retirement plan contribution limits for 2020. Employees in 401(k) plans will be able to contribute up to $19,500 next year, and the catch-up contribution limit for employees aged 50 and over has increased from $6,000 to $6,500. The complete list of notable employer retirement plan increases are summarized below:

The increased contribution limits for employer sponsored retirement plans stand in contrast to the more stagnant limits for IRAs: the limit on annual contributions to an IRA is unchanged at $6,000, along with the IRA catch-up contribution limit which remains at $1,000 for individuals aged 50 or older.

KMK Law articles and blog posts are intended to bring attention to developments in the law and are not intended as legal advice for any particular client or any particular situation. The laws/regulations and interpretations thereof are evolving and subject to change. Although we will attempt to update articles/blog posts for material changes, the article/post may not reflect changes in laws/regulations or guidance issued after the date the article/post was published. Please consult with counsel of your choice regarding any specific questions you may have.

ADVERTISING MATERIAL.

© 2025 Keating Muething & Klekamp PLL. All Rights Reserved

- Partner

Antoinette Schindel practices in KMK Law's Employee Benefits & Executive Compensation Group. Antoinette regularly advises employers regarding Affordable Care Act (ACA) compliance issues, including health coverage and ...

- Partner

Lisa Wintersheimer Michel is the leader of the Employee Benefits & Executive Compensation Group. Her practice primarily involves all aspects of qualified retirement plans, including profit sharing plans, 401(k) plans ...

Topics/Tags

Select- Labor & Employment Law

- Discrimination

- EEOC

- Employment Law

- Title VII

- Social Media

- Religion Discrimination

- Employer Policies

- Labor Law

- Employment Litigation

- Employer Rules

- Wage & Hour

- Coronavirus

- Department of Labor

- Americans with Disabilities Act

- NLRB

- Artificial Intelligence

- Pregnancy Discrimination

- Workplace Violence

- OSHA

- Non-Compete Agreements

- Reasonable Accommodation

- Compliance

- FLSA

- National Labor Relations Board

- Department of Justice

- Worker Classification

- Supreme Court

- Privacy

- NLRA

- Employee Benefits and Executive Compensation

- Harassment

- Diversity

- Arbitration

- FMLA

- Federal Trade Commission

- Workplace Accommodations

- Overtime Pay

- Performance Improvement Plans

- Department of Homeland Security

- Immigration and Customs Enforcement

- Foreign Nationals

- Immigration and Nationality Act

- Litigation

- IRS

- Inclusion

- LGBTQ+

- Medical Marijuana

- Disability Discrimination

- Retirement

- National Labor Relations Act

- Accommodation

- Sexual Orientation Discrimination

- Employer Handbook

- Race Discrimination

- ERISA

- ADAAA

- Unions

- ACA

- Affordable Car Act

- Medical Cannabis Dispensaries

- Technology

- Sexual Harassment

- Whistleblower

- Federal Arbitration Act

- United States Supreme Court

- Transgender Issues

- Disability

- 401(k)

- Sixth Circuit

- Employment Settlement Agreements

- Equal Employment Opportunity Commission

- Fair Labor Standards Act

- Benefits

- Class Action Litigation

- Disability Law

- Gender Identity Discrimination

- Posting Requirements

- Paycheck Protection Program

- E-Discovery

- Evidence

- Securities Law

- Environmental Law

- Family and Medical Leave Act

- Preventive Care Benefits

- Privacy Laws

- Health Savings Account

- SECURE Act

- US Department of Labor Employee Benefits Security Administration

- Healthcare Reform

- Representative Election Regulations

- Older Workers' Benefit Protection Act (OWBPA)

- Telecommuting

- Affirmative Action

- Compensable Time

- Electronically Stored Information

- Equal Opportunity Clause

- Security Screening

- E-Discovery Case Law

- Electronic Data Discovery

- ESI

- Occupational Safety and Health Administration

- Unemployment Insurance Integrity Act

- American Medical Association

- Attendance Policy

- Classification

- Fair Minimum Wage

- Federal Minimum Wage

- Misclassification

- Return to Work

- Seniority Rights

- State Minimum Wage

- Wage Increase

- Confidentiality

- Disability Leave

- Equal Pay

- Genetic Information Discrimination

- Media Policy

- National Origin Discrimination

- Retaliation

- Social Media Content

- Taxation

- Antitrust

- Employment Incentives

- HIRE Act

- Social Security Tax

Recent Posts

- EEOC Takes Aim at Perceived Anti-American Bias

- Ohio “Mini-WARN” Act Now In Effect: Key Compliance Takeaways for Employers

- EEOC's Renewed Focus on Religious Discrimination: What Employers Need to Know

- No Free Delivery: Misclassification Comes at a Price

- One Tweet Away From Trouble: Social Media at Work

- Outsourcing Hiring Won’t Outsource Risk: Implications for Employers Using AI in Hiring

- No Intent, No Liability: Sixth Circuit Narrows Employer Liability for Third-Party Harassment

- AI in Hiring: The Promise, the Pitfalls, and the Response

- Two Big Beautiful Tax Deductions: What Employers Need to Know

- OSHA’s Updated Inspection Program: What Employers Should Know and Expect